While sales are the muscles of a business, cash flow is its life blood. You need to keep cash flowing regularly to pay salaries, buy materials, and literally keep the lights on and the doors open. Many companies are forced to slow their growth simply because they lack the cash inflows necessary to support the cost outflows.

By regulating your cash flow (converting sales into cash in the shortest time) and increasing the spread between inflows and outflows enables you to build a cash cushion that is essential to the long-term, sustained growth of every company, especially smaller ventures.

So here are a few tips to help you improve your cash flow…

Juggle funds between interest-earning accounts

Most banks offer interest-earning chequing accounts that can be used for day-to-day expenses. Since interest rates on these chequing accounts are often below rates on term deposit accounts, keep the bulk of your funds in the higher-interest account and transfer necessary funds from higher-paying accounts to meet the minimum balance requirement in the interest-bearing chequing account plus the total of the payments due that month.

Obviously, it’s important to keep cash easily available, so invest in short-term deposits or only invest a portion of funds that you will not need access to until the term deposit matures.

Dispose of excess and obsolete equipment or inventory

Idle, obsolete, and non-working equipment takes up space and ties up capital which might be used more productively. Equipment that has been owned for a long period will usually have a book value equal to its salvage value or less, so a sale might result in a tax gain.

Excess inventory particularly in the manufacturing sector, can quickly become worthless as customer requirements change. Consider selling any inventory which is unlikely to be used over the next 12 months unless the costs to retain it are minimal and the proceeds from a sale would be negligible.

Request deposits on large or custom orders

When working with a unique or custom order, require a security deposit equal to a minimum of 50% of the total price. One-of-a-kind products have a limited sales value, usually only to the person or company making the order. Without a deposit, you are subject to the risk of having to take a reduced payment at delivery time.

Also having a deposit reduces the likelihood of a financial loss in the worst of circumstances. Be sure that customers understand your policy, and include it in the contract to avoid future difficulties.

Conversely, negotiate minimal deposits with your vendors as that cash can be put to better use elsewhere.

Stagger payments on long contracts

Some customers, due to their size or policies, will refuse to enter into contracts that require initial deposits. Rather than lose the business, negotiate payment terms and benchmarks that exceed or parallel your costs.

For example, a typical construction contract might allow a 25% payment to purchase material, an additional 15% when material is delivered to the site, and 50% of the contract amount at specific progress benchmarks. The remaining 10% of the contract price is usually held by the client until final inspection and acceptance.

Offer discounts for early payments

Develop a discount program to encourage early payments to collect cash owed as fast as possible. Normal payment terms allow a 30-day period for remittance after the receipt of an invoice, with a 2% discount if paid within the first 10 days. You can offer more, less, or no discount for payment, depending upon your needs and your customers’ previous pay habits.

Remember, however, that your ability to institute a collections policy will depend on the strength your customer. A major account might take an offered discount and still pay late.

Penalise late payers with interest penalties

A penalty for late payers is the “stick” in the “carrot and stick” approach to collections, the “carrot” being the discount for early payment. While collecting the interest may not be possible in all instances, the presence of the policy will emphasise the importance of on-time payments to your customers.

Contract a collections agency for old accounts receivable

Pursuing old accounts receivable requires dedication and time, and can quickly reach the point of diminishing returns for your staff. Few small businesses have the resources, training, or experience to effectively pursue delinquent accounts. Furthermore, customers who exceed 60 days for payment without a justifiable reason seldom warrant a continued relationship, and usually require firm measures to extract payment.

Third-party collection agencies are adept at working with such accounts, and generally are willing to pursue collection at their own expense in return for a set percentage of the collected proceeds. In some cases, the agencies will simply purchase the delinquent debt from the business at a discount and assume all subsequent risks of collection.

Introduce a layaway sales programme

Layaway programmes were very popular prior to the widespread use of credit cards. A layaway program allows customers to select a specific product, which is then reserved for a future purchase and delivery when payment has been completed. The seller has the use of the cash prior to the actual delivery of the product.

Repair, rather than replace, equipment

Motor vehicles, properly maintained, easily deliver 100,000 miles of use or more. Modern machinery also is durable and provides years of services. Office machinery usually becomes obsolete before it wears out.

To minimise or eliminate costly repairs and replacement:

- Establish a regular maintenance program for equipment.

- Use reconditioned and replacement parts from third-party suppliers and manufacturers when necessary, rather than original manufactured parts.

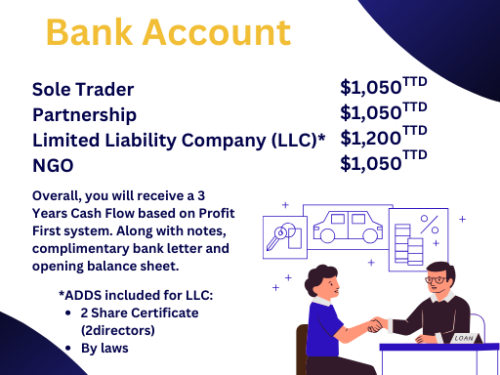

Be sure to join our Facebook, Instagram, Tiktok and our Website for more valuable information. Ask about our Business Startup Kit, Retainer Package, Year End Retainer Package , Business Bank Account or learn how manage your finance with our Prerecorded and Live Courses. Book a FREE 15 mins CONSULTATION on Fridays from 1pm to 3 pm.

“A wealthy person is simply someone who has learned how to make money when they’re not working.” – Robert Kiyosaki