The thirty-somethings have some working experience under their belts and are usually better off financially compared to the fresh graduates. While their income has increased, their financial responsibilities have most likely grown too. Avoid these mistakes in your thirties and stay on top of your game:

Buying a More Expensive House than You Need: More often than not, someone in their thirties is expected to have his/her own house whether he/she is married or not. No doubt, buying a house is a great investment, but a larger house shouldn’t be viewed as a greater investment and accomplishment.

Too many people put themselves through unnecessary financial crisis when they buy a house that is too big for their budget, and their needs. A new family doesn’t require a big home, and most likely they don’t have a sufficient budget for it too.

A bigger house not only means a bigger mortgage, it usually entails more taxes and higher utility bills. Therefore it’s often wiser to start with a small house and move up to bigger ones when your net worth and your family expands.

Not Having a Proper Budget: While you should start budgeting when you are in your twenties, it becomes even more important when you have a family to feed and a mortgage to pay.

If you really want to take control of your money, you need to know where it is going and plan it before you spend it.

Planning a budget may sound daunting, but it is really not. You need to have priorities for your spending and the following is a good rule-of-thumb:

- Top Priority (50% of income) – Essential expenses. These are the expenses you cannot escape. Includes housing, transportation, utilities, groceries, and basic family needs.

- Medium Priority (20% of income) – Saving and investing. You should save 20% of your take home income towards savings and investments every month.

- Low Priority (up to 30% of income) – Lifestyle choices. Eating out in restaurants, giving gifts, buying gadgets. If you want to have a vacation, you should save up using money from this category.

Keeping Up With the Joneses: At this age, you might still be judging someone’s wealth and net worth by their material possessions. Individuals who live in luxury residential areas aren’t necessarily wealthy, and those who live in middle class neighborhood may very well be millionaires.

Remember that when your friend or neighbor goes out and buys a sparkling new SUV, all he does is just signing up for another debt. Those who have nicer things aren’t necessarily more financially well off.

Take pride in your savings and investments instead, and enjoy the financial security and freedom that you have.

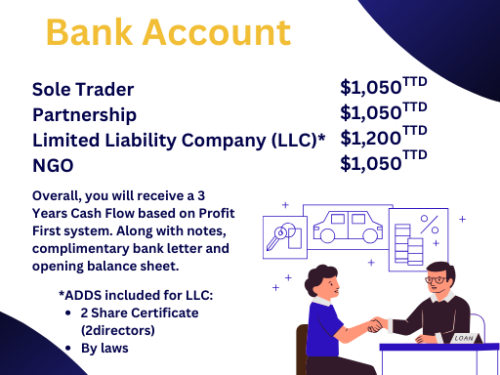

Be sure to join our Facebook, Instagram, Tiktok and our Website for more valuable information. Ask about our Business Startup Kit, Retainer Package, Year End Retainer Package , Business Bank Account or learn how manage your finance with our Prerecorded and Live Courses. Book a FREE 15 mins CONSULTATION on Fridays from 1pm to 3 pm.

“A wealthy person is simply someone who has learned how to make money when they’re not working.” – Robert Kiyosaki