This week we continue with Signs Your Business Is Haemorrhaging Money

You keep up with the Jones’s.

Yes, your main competitor has a swanky new office, the latest gadgets, and spent a fortune on handmade furniture. Yes, that’s infuriating. But here’s the thing. That doesn’t mean that your business isn’t better. They may have dumped all their funding into those expensive materialistic things – which means they can’t invest in improving their business. While your front end needs to look nice so your potential customers see you’re successful, don’t overspend on the furniture and decor for private areas. Remember—you can get just as much work done on a door slapped on top of two filing cabinets as you can on a $5,000 mahogany desk.

You invest in too much technology

Sure, you need computers, phones and Internet access to do business in the 21st century. But no, you don’t need brand-new devices every year or the latest iGadget as soon as it’s launched.

You don’t have an emergency fund.

Setting aside a little something for an unexpected expense is recommended not just for your personal finances but business owners need to do the same. For example, what if you run a transport company and a couple of your trucks are shut down due to flat tires and mechanical problems. With your trucks in the garage, you can’t make money. But, what if you don’t have the money to make the repairs? Now you have to scramble and do something desperate like take out a loan or line of credit.

Your finances are disorganized.

Bookkeeping isn’t at the top of priorities for small companies. But it is necessary if you want to succeed as a business owner. For starters, it makes managing your invoices and expenses a whole lot easier. It is also useful during tax season. Additionally, keeping your books organised makes it easier to claim deductions and secure funding since investors will want to examine your books.

You’re not making wise hiring or outsourcing decisions.

Payroll is typically the biggest expense a business owner is responsible for. It’s one of their most expensive expenses. Hiring the wrong people means that you have to keep training new employees over and over again which increase payroll cost.

But for some jobs, there is no need to hire full-time team members. For example, if your financial information is not in order you can hire a bookkeeper or business accountant. They know which deductions you can claim and how to keep financial records organised. Most of the time they can be hired part-time or on an as-needed basis.

The profit equation has two sides: Money coming in and money going out. As we work our way through the last quarter, it’s a great time to get a handle on where the money is going and watch for these signs that your company is unnecessarily bleeding hard-earned cash.

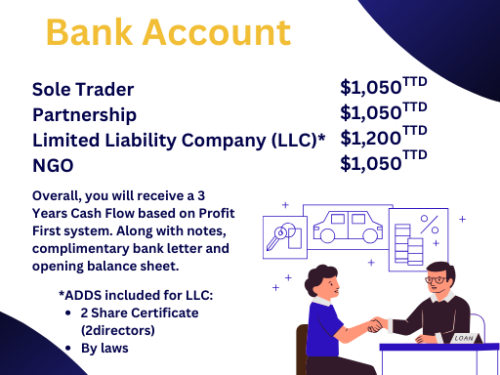

Be sure to join our Facebook, Instagram, Tiktok and our Website for more valuable information. Ask about our Business Startup Kit, Retainer Package, Year End Retainer Package , Business Bank Account or learn how manage your finance with our Prerecorded and Live Courses. Book a FREE 15 mins CONSULTATION on Fridays from 1pm to 3 pm.

“A wealthy person is simply someone who has learned how to make money when they’re not working.” – Robert Kiyosaki