FOR SELF-EMPLOYED PERSONS/SOLE TRADERS

This is a summary of specific taxes which may be applicable to the Sole-trader or Self Employed person and the dates on which they are due and payable. Self employed persons include Taxi Drivers, suitcase traders, vendors, hairdressers, tradesmen, doubles vendors, etc.

A Partnership comprises two or more sole-traders. Therefore the responsibilities of the partners in a partnership are also included hereunder

- First quarterly installments due and payable in respect of Income Tax, Health Surcharge and Business Levy on March 31st.

- Your Income Tax Return for previous year is first due on April 30th. Payment of all outstanding taxes for the previous Income Year is due and payable.

- Interest accrues on all outstanding liabilities at the rate of 20% per annum deadline date May 1st.

- Second Quarterly Installment due and payable on June 30th in respect of Income Tax, Health Surcharge and Business Levy.

- Third Quarterly Instalment due and payable on September 30th in respect of Income Tax, Health Surcharge and Business Levy.

- The last day for filing your previous year Income Tax Return without accruing a penalty for late filing is October 31st .

- An Income Tax return attracts a penalty of $100 for every six months it remains outstanding after November 1st which is the day after the filing day for your previous year Income Tax Return.

- Fourth Quarterly Installment due and payable on December 31st in respect of Income Tax, Health Surcharge and Business Levy.

- If VAT Registered your VAT Return is due and Taxes Payable on the 25th day preceding the Tax Period. For example, if you V.A.T. are payable on Sunday, VAT must be paid by Monday.

- Your Tax Period is any two month period approved by the Board upon registration.

NEW ENTREPRENEURS

The following are the steps to registering your business:

- Register the Business Name with the Registrar of Companies

- Apply for a Board of Inland Revenue File Number (if you don’t already have one)

- Apply for a PAYE Number (if you have employees)

- Apply for a NIS Number (if you have employees)

- Register for VAT (if projected receipts exceed TT$500,000/annum)

TAXATION

Income Tax – Sole Trader/Self-Employed

Chargeable Income/Profits – 25%. Remember you have 11 tax breaks and allowance to use.

Corporation Tax – Limited Liability Company

Chargeable Profits – 30%. It should be paid every quarter on March 30th, June 30th, September 30th and December 31st to avoid penalties and interest.

Health Surcharge – Sole Trader, Partnership and Limited Liability Companies

- When the weekly income is more than TT$ 109 the rate is TT$8.25 – ($429 per year or $107.25 per quarter) per person.

- When the weekly income is less than TT$ 109 the rate is TT$4.80 per week – ($249.60 per year or $62.40 per quarter) per person

Business Levy – Sole Trader and Limited Liability Companies

Entrepreneurs whose sales or receipts are in excess of $200,000 per annum are liable to Business Levy (BLV). The current rate of BLV is 0.6%. It should be paid every quarter on March 30th, June 30th, September 30th and December 31st to avoid feeling overwhelmed at the year end and avoid penalties and interest.

Green Fund Levy – Partnership and Limited Liability Companies

It is calculated based on the income earned. The current rate is 0.3%. It should be paid every quarter on March 30th, June 30th, September 30th and December 31st to avoid penalties and interest.

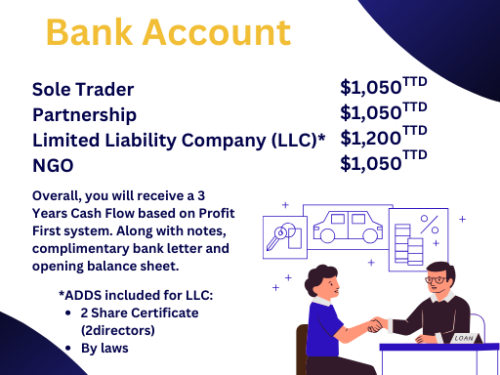

Be sure to join our Facebook, Instagram, Tiktok and our Website for more valuable information. Ask about our Business Startup Kit, Retainer Package, Year End Retainer Package , Business Bank Account or learn how manage your finance with our Prerecorded and Live Courses. Book a FREE 15 mins CONSULTATION on Fridays from 1pm to 3 pm.

“A wealthy person is simply someone who has learned how to make money when they’re not working.” – Robert Kiyosaki