Signs Your Business Is Haemorrhaging Money

Cash is undeniably the lifeblood of your business. When it’s haemorrhaging money, it’s in critical condition. Even companies that are making sales and generating solid revenue sometimes fail as a result of issues with their cash management.

You can prevent that from happening by paying attention to the following warning signs and knowing how to stop the bleeding before it’s too late.

You’re not tracking your expenses.

Don’t feel too embarrassed about this. There are many businesses that aren’t tracking their expenses like utilities, rent and payroll. However, that’s a problem for business owners because this doesn’t let them know how much they’re spending or earning. In other words, if you’re spending more than your business is bringing in, then you’re just asking for a financial disaster.

You’re unable to file your taxes.

Few expenses are as great as your taxes. An obvious indication that you’re struggling with your cash flow management is your inability to pay VAT, NIS or income taxes on time. Due to the excessive costs of tax penalties, you’d be smart to pay your taxes on time and in full.

You have trouble meeting payroll.

Payroll is arguably your second most important expense after taxes. So, if you’re stressed out about paying your employees, then you can be certain that you’re in serious financial trouble.

You’re unable to meet payables in a timely manner.

If you’ve successfully covered your tax and payroll expenses but you’re still having trouble paying your suppliers or vendors, you simply don’t have enough cash to pay all of your expenses. Many suppliers charge interest on late payments, which whittles away your profit.

Your customer invoices haven’t been paid in over 90 days.

If an invoice hasn’t been paid within 90 days, then chances are you won’t be paid. In fact, only 20% percent of those invoices get paid following 90 days. And, if you aren’t bringing money in, then how can you pay your expenses?

You don’t negotiate.

While the price tag is set-in-stone during in-store transactions, if you aren’t negotiating with vendors, then you’re overpaying. Always make a counteroffer on any deal you make with a vendor.

Next week Part 2…

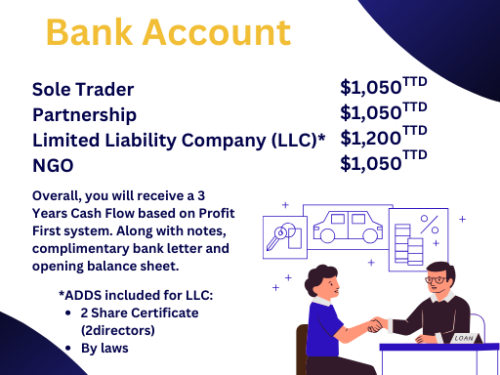

Be sure to join our Facebook, Instagram, Tiktok and our Website for more valuable information. Ask about our Business Startup Kit, Retainer Package, Year End Retainer Package , Business Bank Account or learn how manage your finance with our Prerecorded and Live Courses. Book a FREE 15 mins CONSULTATION on Fridays from 1pm to 3 pm.

“A wealthy person is simply someone who has learned how to make money when they’re not working.” – Robert Kiyosaki