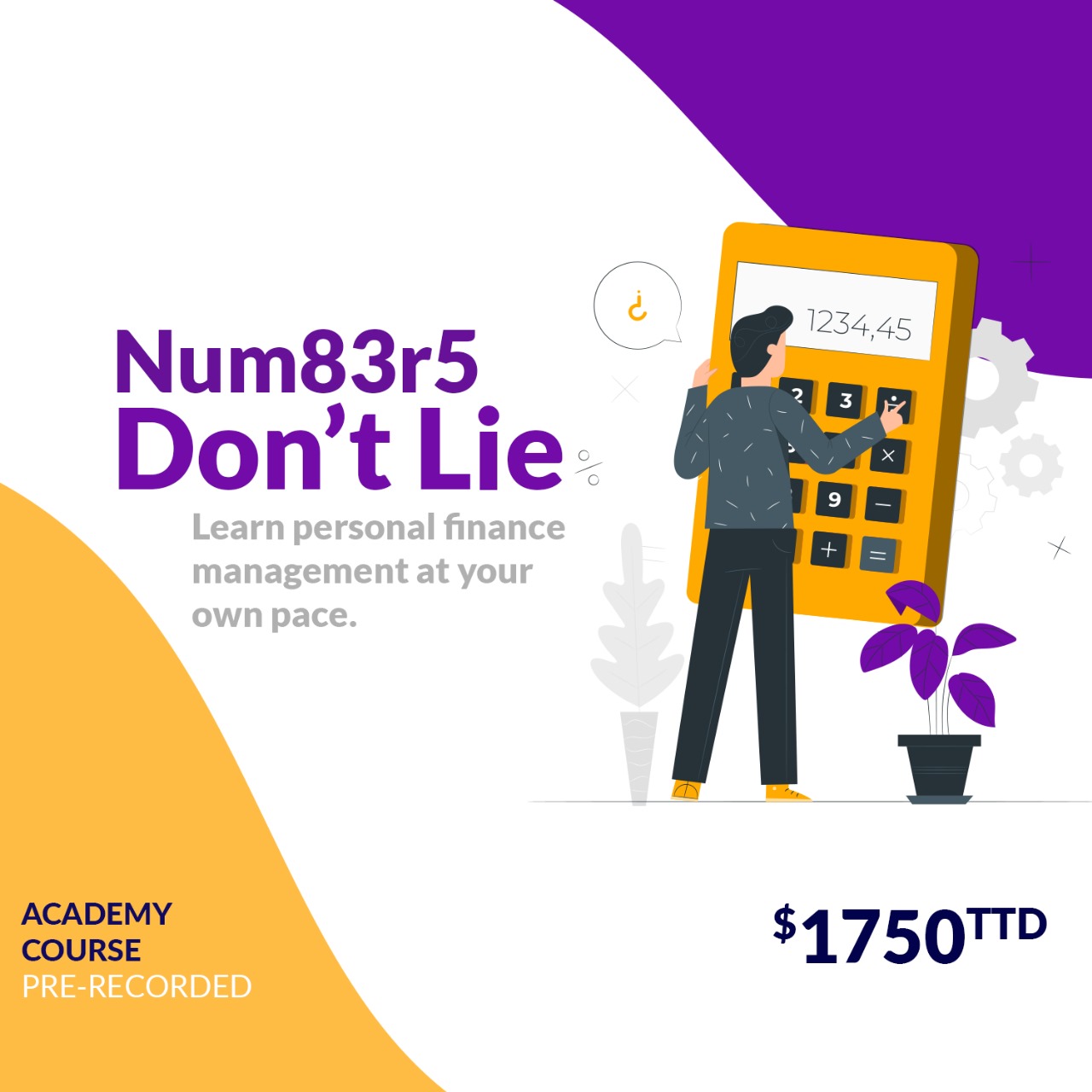

Num83r5 Don’t Lie (Excel) is a pre-recorded self-paced course teaching how to manage your business activities and pay your taxes using Excel Worksheets.

Num83r5 Don’t Lie (Excel)

$1,750.00

Description

Num83r5 Don’t Lie (Excel) is a pre-recorded self-paced course teaching how to manage your business activities and pay your taxes using Excel Worksheets. You can track and analyze your financial data very easily. As well as, you will receive the following worksheets:

- Business and Personal Budget

- Cash Flow Forecast

- Income

- Petty Cash and Cheque

- Banking

- Fixed Asset

- Tax for Sole Trader, Partnership and Limited Liability Company

- V.A.T.

You will learn how to:

- Etax preparation and filing.

- V.A.T. preparation and payments (annual income exceeds $600,000).

Cost: $1,750TT

Payments are as follows:

![]()

![]()