Continuing our questions to ask before buying stock…

How Profitable Is It?: In addition to growth, look at how efficiently the company makes money. Return on assets shows how well it has translated a dollar of its asset base into a dollar of profits. A company with a return on assets of 20%, for example, has produced $0.20 of earnings from each dollar of assets. Similarly, return on equity measures how well the firm has turned a dollar of shareholders equity into earnings.

Measures like return on equity and return on assets help you understand how efficiently a company allocates its resources, and they allow you to look beyond raw profit numbers. Companies with the same earnings figures might have very different returns on equity and returns on assets, depending on how well they have turned their assets into profits.

How Healthy Are Its Finances?: Earnings and cash flow are two different things. You could earn a very generous salary but still run into cash-flow problems if you get paid only twice a year. Because of quirks in accounting practices, a company’s reported earnings often differ from the amount of cash it brings in the door. The statement of cash flows, which is part of the annual report, will tell you just how much of the money a company pocketed.

It’s also important to see how the company uses that cash. By digging into the cash flow statement to find out where the money’s going can shed light on management’s strategy and give you additional insight into the company’s future. Is it building aggressively for the future by opening new stores or building new manufacturing facilities? Is it buying other firms, paying off debt, and building up cash reserves, buying back stock, or paying dividends?

Companies can also issue debt to finance new plants and research efforts or to bail itself out of short term cash problems. Companies need to watch their debt levels, though. Too much borrowing can force the company to use its cash to pay interest, instead of applying it to more productive ends.

No hard-and-fast rule will tell you how much debt is appropriate for a particular company, because levels of indebtedness can vary across industries. To get an idea of whether a company is overburdened by debt, divide its assets by its equity. The result is the company’s financial leverage.

Is It Worth the Price?: A company might clear all these hurdles, but sell at too high a price to be an attractive investment. It all depends on how much its prospects are worth.

To figure that out, look at its forward Price/Earnings ratio, for example if Destiny Planner has a forward P/E of 31, it means that the shareholders now pay $31 for $1 of the company’s future earnings.

Another widely used measure is the Price/Book ratio. This shows how much shareholders are paying for $1 of the company’s assets.

Whichever ratio you use, compare it with its parallels for other companies in its industry and for the market as a whole. That will tell you how expensive the stock is, relatively speaking. Remember, stocks with very high P/E and P/B ratios can fall dramatically when any little thing goes wrong.

Analysing stocks isn’t easy, but you will be off to a solid start if you ask these questions first before buying a stock.

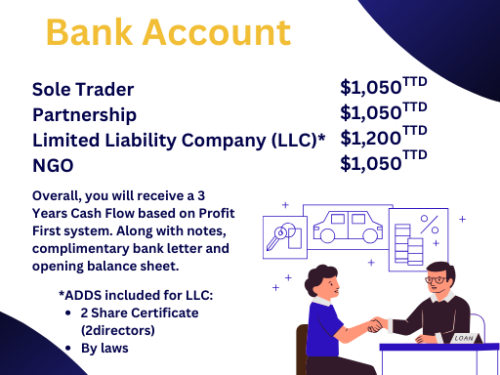

Be sure to join our Facebook, Instagram, Tiktok and our Website for more valuable information. Ask about our Business Startup Kit, Retainer Package, Year End Retainer Package , Business Bank Account or learn how manage your finance with our Prerecorded and Live Courses. Book a FREE 15 mins CONSULTATION on Fridays from 1pm to 3 pm.

“A wealthy person is simply someone who has learned how to make money when they’re not working.” – Robert Kiyosaki