Mutual funds are perhaps the easiest and least stressful way to invest in the market. In fact, more new money has been introduced into funds during the past few years than at any time in history. Before you jump into the pool and start throwing your money at mutual funds, you should know exactly what they are and how they work. We at Destiny Planners hope that this article can give you the foundation you need to start understanding mutual fund investing.

What is a mutual fund? Simply, a mutual fund is a collection of stocks, bonds or other securities. When you buy you own the share of the mutual fund. The price of each mutual fund share is called its NAV, or net asset value. That’s the total value of all the securities it owns divided by the number of the mutual fund’s shares. Mutual fund shares are traded continuously, but their prices adjust at the end of each business day.

Mutual funds are divided along four lines: closed-end and open-ended funds; the latter is subdivided into load and no load.

- Closed-End Funds: has a set number of shares issued to the public through an initial public offering. These shares trade on the open market; this, combined with the fact that a closed-end fund does not redeem or issue new shares like a normal mutual fund, subjects the fund shares to the laws of supply and demand. As a result, shares of closed-end funds normally trade at a discount to net asset value.

- Open-End Funds: The majority of mutual funds are open-ended. In a basic sense, this means that the fund does not have a set number of shares. Instead, the fund will issue new shares to an investor based upon the current net asset value and redeem the shares when the investor decides to sell. Open-end funds always reflect the net asset value of the fund’s underlying investments because shares are created and destroyed as necessary.

- Load vs. No Load: A load, in mutual fund speak, is the sales commission. If a fund charges a load, the investor will pay the sales commission on top of the net asset value of the fund’s shares. No-load funds tend to generate higher returns for investors due to the lower expenses associated with ownership.

What are the benefits of investing in a mutual fund? Mutual funds are actively managed by a professional money manager who constantly monitors the stocks and bonds in the fund’s portfolio. Because this is his or her primary occupation, they can devote considerably more time to selecting investments than an individual investor. It provides the peace of mind that comes with informed investing without the stress of analysing financial statements or calculating financial ratios.

Next week, How to select a mutual fund and the pros and cons of investing in a mutual fund…

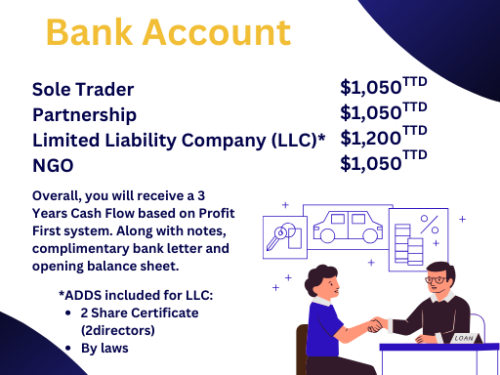

Be sure to join our Facebook, Instagram, Tiktok and our Website for more valuable information. Ask about our Business Startup Kit, Retainer Package, Year End Retainer Package , Business Bank Account or learn how manage your finance with our Prerecorded and Live Courses. Book a FREE 15 mins CONSULTATION on Fridays from 1pm to 3 pm.

“A wealthy person is simply someone who has learned how to make money when they’re not working.” – Robert Kiyosaki