Our Partnership Tax Preparation Service removes the confusion and overwhelming feeling when it comes to preparing your taxes. Thereby, making filing and paying taxes seamless and stress-free.

Partnership Tax Preparation

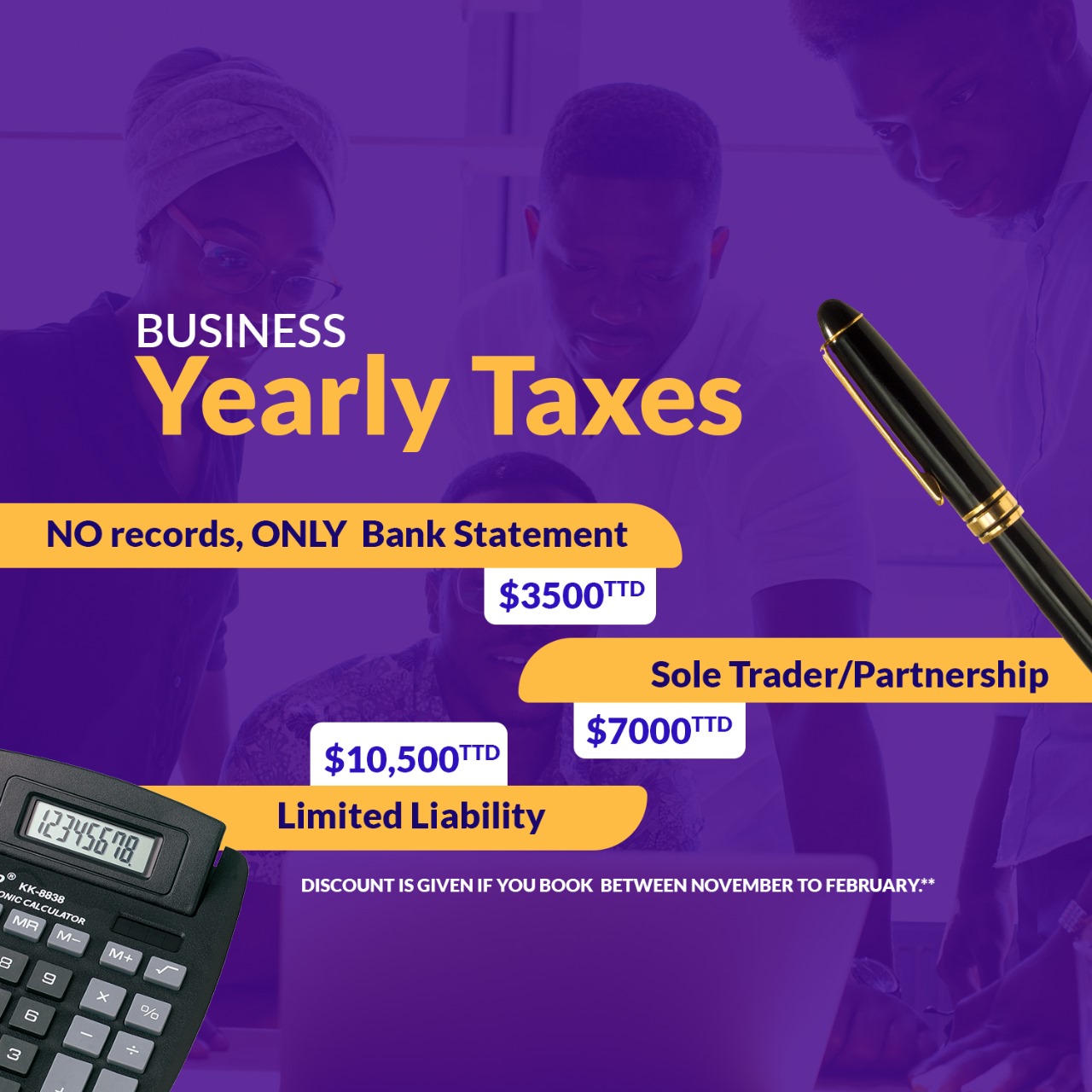

$7,000.00

Description

Partnership Tax Preparation Requirements:

- Sales invoices and receipts

- Cheque and cash payments including foreign and local expense, detailed payroll records for staff and entrepreneurs

- Bank statements for the period including credit card and bank

- Tax receipts including N.I.S., Health Surcharge, P.A.Y.E., V.A.T., and quarterly tax, if any during the year,

- Fixed assets listing for the period,

- Rental receipts if the client runs a home-based business, please provide your monthly rent figure.

- Approved Annuity payments for the period, ONLY for a sole trader.

- Applicable to limited liability only if the business pays on behalf of its owners.

- Approved Deed of Covenant for the period.

- Provide Prior Year Tax Return

Benefits:

– Tax return completed before April 30th

– No real estate space needed for another staff member on your premises

$7,000TTD

Discount is given, if you book between November to February.** Also, for more than one year filing.

Payments are as follows: