This week, the final in the savings series, what we all look forward to…retirement

Retirement – The 10% Rule

This is probably the most traditional rule of thumb when it comes to saving for retirement. Save ten percent of your income toward retirement.

Why it works: It gives people a simple number to work with. If you’re young, you’ve just opened an annuity, and you’re not sure how much of your earnings to set aside, 10% is a good start.

When it doesn’t: While simple, the percentage doesn’t consider how much you’ll actually need in retirement. It also doesn’t consider how much you’ve currently saved. If you’re playing catch-up, you’ll probably need to save considerably more than ten percent of your income. If you want to retire early, or more lavishly, you’ll probably need to save more than ten percent.

Here’s another rule of thumb for deciding how much to set aside for retirement. You should save 20x your gross annual income.

Why It Works: It actually focuses on what you’ll need in the future.

When It Doesn’t: Your retirement expenses might differ from how much income you earn now. Depending on the lifestyle you plan to live, you may need a lot more, or less, than your income.

These rules give you a decent ballpark figure of how much to save. But if you want to get a more complex picture that considers all the variables, talk the time to consider what you want to do in retirement then calculate how much that lifestyle will cost.

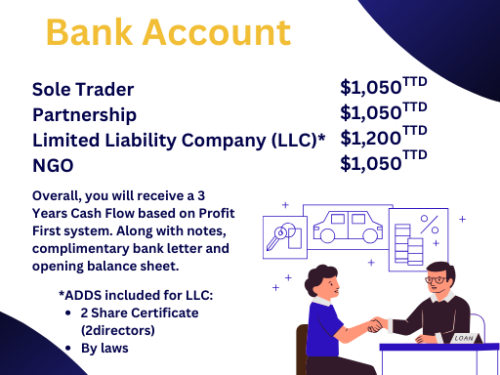

Be sure to join our Facebook, Instagram, Tiktok and our Website for more valuable information. Ask about our Business Startup Kit, Retainer Package, Year End Retainer Package , Business Bank Account or learn how manage your finance with our Prerecorded and Live Courses. Book a FREE 15 mins CONSULTATION on Fridays from 1pm to 3 pm.

“A wealthy person is simply someone who has learned how to make money when they’re not working.” – Robert Kiyosaki