Today we continue with what you must understand before you invest in the stock market…

Decide how much you want to invest: Always remember one basic rule in finance — if something gives you higher returns, that is usually because it carries a greater risk.

That’s the reason why not-so-good companies will pay you a higher rate of interest for your deposits.

The same reasoning goes for stocks too — they give higher returns than, say, bank fixed deposits because they are more risky. So the amount of money you invest in the market depends on your capacity to bear the risk.

If you are young with a steady job, you can invest a larger proportion of your income in the stock market than, say your parents who are close to retirement. If you have a lot of debt to repay, avoid putting too much of your money in stocks.

It’s best to decide how much of your savings you will allocate to stocks, and stick to that plan. Don’t get swayed by how much your friend is investing.

Don’t rely solely on ‘good advice’: A smart investor should never invest buy shares of companies he doesn’t know much about. Relying on ‘advice’ from friends is not always a great idea. Do some groundwork yourself.

It doesn’t matter who is buying the stock or who is recommending it. Steer clear of such ways of making a fast buck. These tips will land you in trouble. When you hear of a ‘hot tip’, dig further.

Take a look at the company’s profit and loss statement, which would have been audited by chartered accountants. There is a wealth of information here.

Do some basic calculations on your own. The Earnings Per Share (net profit/ number of shares) and Price/Earnings ratio (market price/ EPS) should give you a fair understanding.

These tips should get you started. Tread cautiously though. If stocks intimidate you, consider a diversified equity fund.

A mutual fund manager or stock broker will research many companies before investing in their shares. This way, you can participate in the stock market even as you leave the research to professionals.

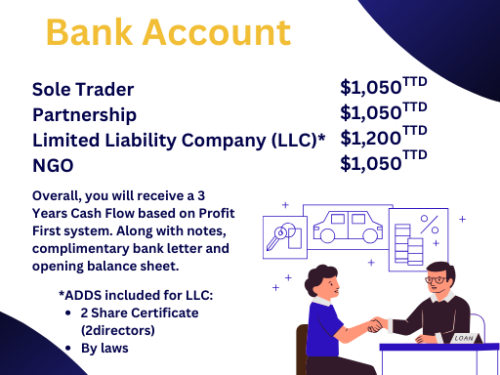

Be sure to join our Facebook, Instagram, Tiktok and our Website for more valuable information. Ask about our Business Startup Kit, Retainer Package, Year End Retainer Package , Business Bank Account or learn how manage your finance with our Prerecorded and Live Courses. Book a FREE 15 mins CONSULTATION on Fridays from 1pm to 3 pm.

“A wealthy person is simply someone who has learned how to make money when they’re not working.” – Robert Kiyosaki